Minimising Customer Waiting Times

The Challenge

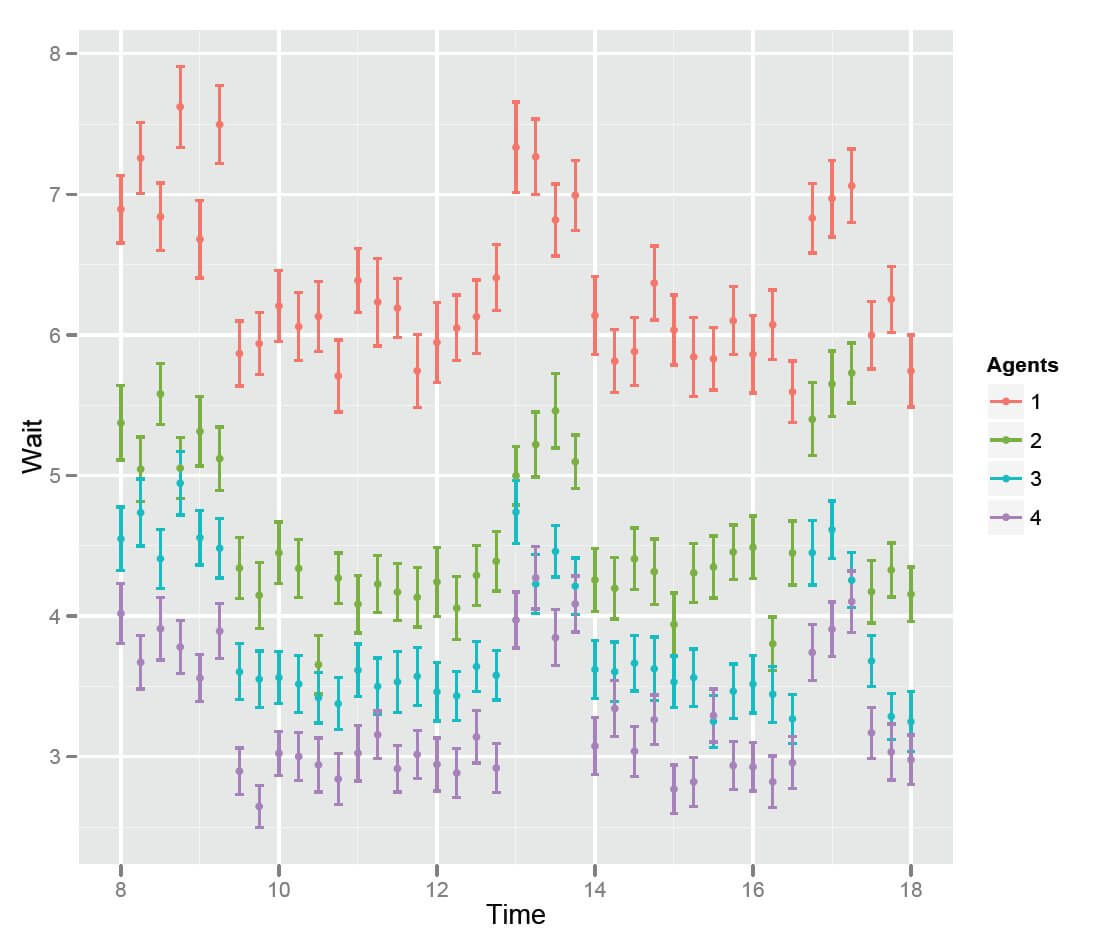

A bank would like to keep customer waiting times below 5 minutes in order to ensure an appropriate level of customer service. The wait time depends on two primary factors: the time of day and the number of tellers operating. There is a fine balance to be made as it is not a cost-effective strategy to have more tellers operating than necessary.

The Approach

An operational analysis of the waiting time given the time of day and varying numbers of tellers is used to indicate the optimal number of tellers required. This analysis found that, whilst two is sufficient for most of the day, an additional teller is needed during the morning, lunchtime and evening (but any more would be wasteful). As a result, the bank decides to put two tellers on duty during the day and increase to three during busy times. An additional analysis suggests that efficiency can be further improved by working in rotation during quieter periods – so no teller is at the window for more than two hours at a time.

Figure 1: Waiting times for each teller given the time of day.

The Value

The benefits to the bank in carrying out a formal operational assessment are clear; wait times are shorter and staff are fresher when dealing with customers; both of which improve customer service levels.